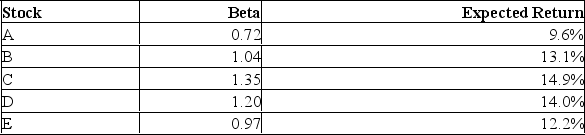

Which one of the following stocks is correctly priced if the risk-free rate of return is 3.8% and the market risk premium is 8.5%?

Definitions:

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) aimed at making global financial reporting more transparent and comparable.

Realized Gross Profit

The portion of profit that has been earned from completed sales transactions, excluding unrealized profits from continuing transactions.

Bundled Sales Transactions

sales deals that involve multiple products or services sold together at a combined price, potentially affecting revenue recognition and reporting.

Revenue Recognition

The accounting principle that dictates the specific conditions under which revenue is recognized and recorded in the financial statements.

Q40: Investors shouldn't count capital gains as part

Q66: The cost of preferred stock:<br>A) Is equal

Q79: The reward-to-risk ratio for Stock X exceeds

Q92: The reward for bearing risk in the

Q136: The CAPM shows that the expected return

Q171: An investor purchases 1,000 shares of a

Q175: Kurt's Adventures, Inc. stock is quite cyclical.

Q227: The risk-free rate of return is 3.78%

Q278: Capital market efficiency is attributable largely to

Q326: The market value of DRK Inc.'s debt