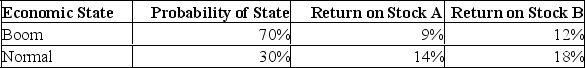

What is the standard deviation of a portfolio that is invested 40% in stock A and 60% in stock B, given the following information?

Definitions:

Evolution

The process by which different kinds of living organisms are thought to have developed and diversified from earlier forms during the history of the earth.

Genetic Bottleneck

A genetic bottleneck is an event where a significant reduction in population size occurs, leading to a decrease in genetic diversity and a change in allele frequencies.

Tasmanian Devils

A carnivorous marsupial found in Tasmania, known for its strong jaws, loud vocalizations, and nocturnal habits.

Founder Effect

A genetic phenomenon where a new population is established by a very small number of individuals from a larger population, leading to a reduced genetic diversity in the new population.

Q50: Which one of these statements is correct

Q75: The higher the standard deviation, the less

Q79: The reward-to-risk ratio for Stock X exceeds

Q118: If a market has semi-strong efficiency, then

Q129: The market risk premium of an individual

Q131: The interest rate that should be used

Q164: Baker's Chocolate common stock had annual returns

Q187: You own a portfolio with the following

Q209: A decrease in the amount of systematic

Q247: What is the portfolio variance if 55%