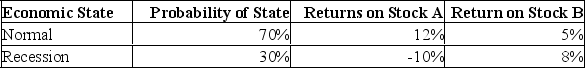

What is the expected return on a portfolio that is invested 40% in stock A and 60% in stock B, given the following information?

Definitions:

Operating Point

The steady-state condition where a system or component operates, often determined by balancing external inputs with the system's response.

Process Variable

A process variable is any measurable condition in a process or system, such as temperature, pressure, or flow rate, which can be controlled and monitored.

Continuous Process

A manufacturing or chemical process that operates uninterrupted, as opposed to batch processing which occurs in distinct steps.

Q20: Topstone Industries is expected to pay a

Q22: According to theory, studying historical prices in

Q65: What is the standard deviation of a

Q91: An investor purchases 500 shares of a

Q167: Suppose a firm has 10.4 million shares

Q187: The U.S. Securities and Exchange Commission periodically

Q205: If a firm applies its overall cost

Q217: One year ago, you purchased a stock

Q253: If all securities plot on the security

Q267: What is the portfolio variance if 60%