Multiple Choice

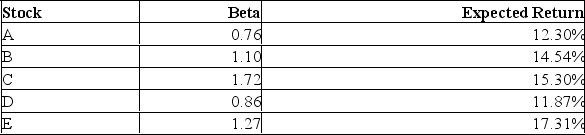

Which one of the following stocks is correctly priced if the risk-free rate of return is 4.2% and the market rate of return is 13.6%?

Definitions:

Related Questions

Q29: Systematic risk is measured by _ and

Q49: A stock has a beta of 1.2

Q52: Provide a graphical representation of the volatility

Q56: Explain why it is that in an

Q122: Calculate the standard deviation of an investment

Q177: A security that has a rate of

Q209: You just sold 200 shares of Langley,

Q270: Given the following information for Jano Corp.

Q354: You form a portfolio by investing equally

Q374: The weights that are commonly used when