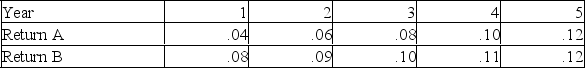

Which of the following two stocks is more volatile based on historical returns?

Definitions:

Significantly Correlated

A statistical relationship between two variables where changes in one variable are reliably associated with changes in another variable, often verified through statistical tests.

Caffeine Consumed

The amount of caffeine intake in a given period; not a key term in a statistical or general scientific context, thus NO.

P < 0.05

A statistical significance level indicating that there is less than a 5% probability the observed results occurred by chance, suggesting a significant difference or effect.

Directional

A hypothesis that specifies the direction of the expected relationship between variables.

Q24: Over the past five years, Redstone Enterprises

Q86: The total return on a security is

Q100: The nominal rate of return minus the

Q105: The possibility that errors in projected cash

Q131: You are considering a project that you

Q219: A project has an initial cost of

Q269: The news that influences the unanticipated rate

Q286: Which one of the following statements is

Q327: You are an investor who studies the

Q399: TD, Inc. is analyzing a new project.