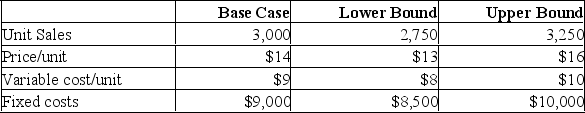

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  What is the worst case NPV for the project?

What is the worst case NPV for the project?

Definitions:

Limited Liability Company

A business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability protections of a corporation.

Organizational Form

Refers to the structure and design of an organization, determining the hierarchy, communication flow, and allocation of responsibilities.

Limited Liability

A legal status where a person's financial liability is limited to a fixed sum, most often the value of a person's investment in a corporation or partnership.

Management

The process of dealing with or controlling things or people, often within an organization.

Q75: The higher the standard deviation, the less

Q87: A company owns a building that is

Q104: To convince investors to accept greater volatility

Q162: The option to wait may be of

Q206: The average compound return earned per year

Q212: Shelly's Boutique is evaluating a project which

Q247: Calculate the geometric return of an investment

Q304: Ben's Border Café is considering a project

Q346: For the purpose of performing capital budgeting

Q360: The accounting break-even point has an operating