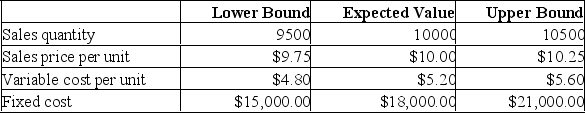

Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000

Initial requirement for equipment: $120,000

Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

What is the degree of operating leverage under the worst-case scenario?

Definitions:

Variable Overhead Rate Variance

The difference between the actual variable overheads incurred and the expected variable overheads based on standard rates.

Labor Rate Variance

The difference between the actual labor rate paid and the standard rate expected, multiplied by the total hours worked.

Labor Efficiency Variance

The variance between the real hours spent producing a good or service and the anticipated standard hours, times the standard wage rate.

Variable Overhead Rate Variance

The difference between the actual variable overhead costs incurred and the standard variable overhead expected for the actual production achieved.

Q7: You own a house that you rent

Q21: Ski World is considering a new product

Q109: The excess return required on a risky

Q133: If a company insider uses all of

Q138: If a division of a firm faces

Q183: Six months ago, you purchased 50 shares

Q259: A decrease in the corporate tax rate

Q259: Provide a definition for the term cash

Q294: Thompson & Son have been busy analyzing

Q360: You are to calculate operating cash flow