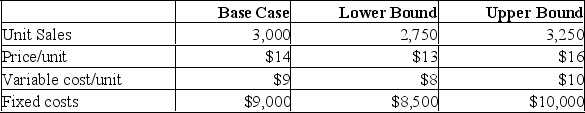

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  Suppose you want to conduct a sensitivity analysis for the possible changes in unit sales. What is the IRR when the sales level equals 3,250 units?

Suppose you want to conduct a sensitivity analysis for the possible changes in unit sales. What is the IRR when the sales level equals 3,250 units?

Definitions:

Sales Commissions

Payments made to salespersons, which are typically a percentage of the sales they generate.

Contract Price

The total monetary amount agreed upon in a contract for the sale of goods or services.

Repudiates

The act of refusing to accept or be associated with something, such as a contract or agreement.

Unfit Seed

Seeds that are unsuitable for planting due to poor quality, contamination, or being genetically modified without approval.

Q7: Donald and Sons manage a product with

Q35: The excess return you earn by moving

Q86: Wilson's Meats has computed their fixed costs

Q153: A firm has fixed costs of $30,000

Q166: Using the tax shield approach, calculate OCF

Q167: Opportunity costs should be included in the

Q194: Your company may introduce a new line

Q223: Conventional capital budgeting analysis will tend to

Q341: When firms do not have sufficient available

Q354: The costs that occur when the number