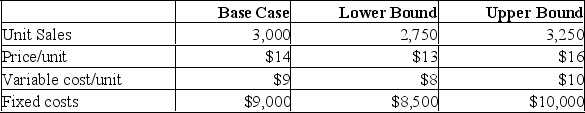

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  Suppose you want to conduct a sensitivity analysis for the possible changes in unit sales. What is the IRR when the sales level equals 3,250 units?

Suppose you want to conduct a sensitivity analysis for the possible changes in unit sales. What is the IRR when the sales level equals 3,250 units?

Definitions:

Market Price

The going rate at which a service or asset can be sold or bought in the marketplace.

Conservation

The responsible management of the environment and natural resources to prevent depletion and harm, ensuring their sustainability for future generations.

Property Rights

Rights that legally entitle individuals to own, utilize, and transfer both physical and intellectual property.

Open Ocean

Refers to the vast, deep body of saltwater that covers most of the Earth's surface, not enclosed by land.

Q62: In a financial break-even calculation, the operating

Q63: The dividend yield is computed as the

Q82: PK Properties purchased a warehouse for $1.6

Q97: The variance is the:<br>A) Average risk premium

Q193: Over the long-term, the greater the volatility

Q201: Which one of the following has the

Q215: Six months ago, you purchased 1,300 shares

Q238: Over the past five years, a stock

Q262: The variance is defined as the:<br>A) Average

Q308: Which of the following best describe the