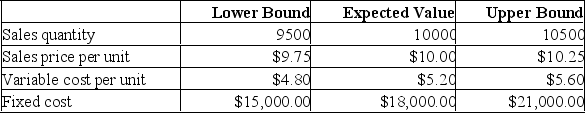

Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000

Initial requirement for equipment: $120,000

Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

The project is operating at the ________ under the base-case scenario.

Definitions:

Off-price Retailers

Retailers who provide high quality goods at lower prices by selling excess inventory or out-of-season items procured from wholesalers or manufacturers.

Stock Merchandise

Stock Merchandise refers to the inventory of goods that a retailer has on hand to sell to customers.

Service Retailer

A business that primarily sells services rather than tangible products, catering to customers' needs through the provision of expertise or activities.

Zumba Dance Classes

Fitness classes that combine Latin and international music with dance moves to create a dynamic, effective, and fun workout environment.

Q16: The Quick Producers Co. is analyzing a

Q100: If a firm wishes to recapture 100%

Q103: Today, you sold 200 shares of SLG,

Q127: The hypothesis that market prices reflect all

Q165: The total of the deviations of actual

Q207: Costs that can be considered sunk costs

Q209: BASIC INFORMATION: A three-year project will cost

Q217: A project has an accounting break-even point

Q233: You own a house that you rent

Q262: The bottom-up approach is used for calculating