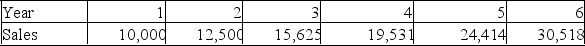

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight-line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the end of the project is estimated to be $50,001. Projected sales volume for each year of the project is shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4 through 1. A $30,000 initial investment in net working capital is required, with additional investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on investment of 12%.  What is the NPV of the project?

What is the NPV of the project?

Definitions:

Medicare

A federal health insurance program in the United States primarily for people 65 years of age and older.

National Health Insurance

A governmental insurance scheme which covers the health care expenses of its citizens.

Blind

The condition of lacking visual perception due to physiological or neurological factors.

Disabled

Refers to individuals who have a physical or mental condition that limits their movements, senses, or activities.

Q5: Consider the following statement by a project

Q17: Which of the following is true about

Q18: The bottom-up approach to computing the operating

Q101: Which of the following statements regarding operating

Q157: An analysis of what happens to the

Q224: Provide a definition for the term marginal

Q286: A company owns a building that is

Q319: Net present value is highly independent of

Q321: Sensitivity analysis helps you determine the:<br>A) Range

Q349: A project has the following estimated data: