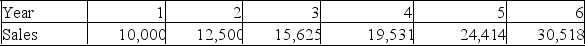

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight-line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the end of the project is estimated to be $50,001. Projected sales volume for each year of the project is shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4 through 1. A $30,000 initial investment in net working capital is required, with additional investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on investment of 12%.  What are the additions to NWC during year 4 of the project?

What are the additions to NWC during year 4 of the project?

Definitions:

Armed Rebellion

Armed rebellion is a violent uprising against an established government or authority, typically with the goal of overthrowing the existing regime or achieving independence for a specific region.

Economic Inequality

Describes the unequal distribution of wealth, income, or resources among individuals, households, or populations within a society.

Birth Rates

The number of live births per thousand of population per year.

Q11: Explain how the statement of comprehensive income

Q70: _ quantifies, in dollar terms, how stockholder

Q89: Matty's Place is considering the installation of

Q99: Jacob's Jewelers is considering carrying a new

Q189: The present value of an investment's future

Q212: Shelly's Boutique is evaluating a project which

Q308: Floyd Clymer is the CFO of Bonavista

Q316: Jack is considering adding work jeans and

Q317: Your company purchased a piece of land

Q401: Angelo knows that the selling price of