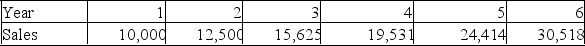

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight-line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the end of the project is estimated to be $50,001. Projected sales volume for each year of the project is shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4 through 1. A $30,000 initial investment in net working capital is required, with additional investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on investment of 12%.  What is the NPV of the project?

What is the NPV of the project?

Definitions:

Organization's Performance

A measure of how well an organization achieves its set objectives and goals through efficient and effective use of resources.

Local Supplier

A business that provides products or services to another company within the same geographic region, often to minimize logistics costs and support the local economy.

Decision-making

The process of making choices by identifying a decision, gathering information, and assessing alternative resolutions.

Effectiveness

The degree to which something achieves its desired outcome or succeeds in producing a specified result, often used in evaluating strategies, interventions, or performances.

Q54: The proper formula of project cash flow

Q163: Project A has a five-year life and

Q185: Matthew's Construction is considering a project that

Q209: Your firm needs a computerized line-boring machine

Q212: If you want to determine the entire

Q224: The use of the profitability index could

Q260: A project has an initial investment of

Q302: The advantages of the payback method of

Q352: A gas station owner expands floor space

Q401: The average accounting return (AAR) rule can