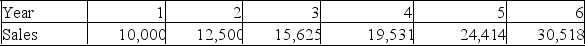

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight-line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the end of the project is estimated to be $50,001. Projected sales volume for each year of the project is shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4 through 1. A $30,000 initial investment in net working capital is required, with additional investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on investment of 12%.  What are the additions to NWC during year 4 of the project?

What are the additions to NWC during year 4 of the project?

Definitions:

Q32: LaMont and Sons is considering the purchase

Q182: Which of the following is calculated using

Q185: Which one of the following statements is

Q188: A project will produce an operating cash

Q242: Total cash flow from a project is

Q261: Hansel's Outings is considering opening a new

Q328: An increase in which one of the

Q345: _ is the focus of corporate finance

Q391: Without using formulas, provide a definition of

Q415: What is the payback period for the