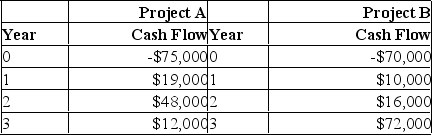

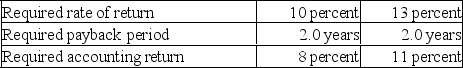

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Based upon the internal rate of return (IRR) and the information provided in the problem, you should:

Based upon the internal rate of return (IRR) and the information provided in the problem, you should:

Definitions:

Return on Investment

A metric for assessing the effectiveness or gains of an investment, determined by dividing the net earnings by the investment's expense.

Minimum Return on Investment

The least amount of profit expected from an investment, below which an investment is not considered acceptable.

Investment Turnover

A measure of a company's ability to generate sales from its investment in assets, typically used to assess the efficiency of investment usage.

Profit Margin

A ratio of profitability calculated as net income divided by revenue, showing the percentage of each dollar of revenue that results in net income.

Q5: Corey is considering two projects both of

Q37: Dividends are a tax deductible expense.

Q121: An increasing emphasis by financial executives on

Q240: It is important to identify and use

Q247: Deltona Homes common stock sells for $52.64

Q261: The current yield on Martin's Mills common

Q263: Without using formulas, provide a definition of

Q264: Assuming that straight line depreciation is used,

Q265: F & D Industry's common stock sells

Q278: The length of time needed to recover