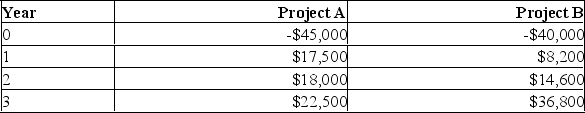

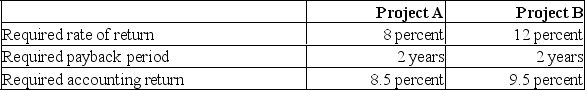

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

You should accept Project ____ because it has the _____ profitability index of the two projects.

You should accept Project ____ because it has the _____ profitability index of the two projects.

Definitions:

Cyclical Variation

Periodic fluctuations in data or trends that happen over longer time intervals and are often related to economic, environmental, or societal cycles.

Seasonal Variation

A pattern seen in statistical data that occurs at regular intervals due to seasonal factors.

Random Variation

The unpredictability in the behavior or outcome of a process, due to the influence of random factors or noise.

Cyclical Variation

Fluctuations in statistical or economic data that occur periodically over cycles, such as those caused by the business cycle.

Q12: The depreciation tax shield is defined as

Q127: The Sister's Market is preparing to pay

Q174: If a project with conventional cash flows

Q187: A 6% preferred stock pays _ a

Q193: The managers of PonchoParts, Inc. plan to

Q219: Which of the following is NOT correct?<br>A)

Q251: A stock's next expected dividend divided by

Q321: The equivalent annual cost method of analysis

Q353: You are analyzing the following two mutually

Q379: How much are you willing to pay