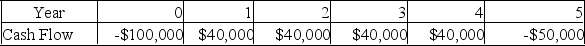

You are considering an investment with the following cash flows. Your required return is 10%, you require a payback of three years and a discounted payback of four years. If your objective is to maximize your wealth, should you take this investment?

Definitions:

Late Blastula

A stage in embryonic development characterized by a spherical layer of cells (the blastoderm) surrounding a fluid-filled cavity (the blastocoel).

Morula

A solid ball of cells resulting from division of a fertilized ovum, and from which a blastula is formed.

Primitive Streak

Dynamic, constantly changing structure that forms at the midline of the blastodisc in birds, mammals, and some other vertebrates. It is active in gastrulation as cells migrate to a narrow furrow at its center, the primitive groove, and sink into the interior of the embryo. The anterior end of the primitive streak is Hensen’s node.

Epiblast

An early embryo layer from which all the three primary germ layers develop during gastrulation in the formation of a vertebrate body.

Q43: Which of the following is NOT usually

Q79: When two projects both require the total

Q207: Without using formulas, provide a definition of

Q242: Explain why the internal rate of return

Q278: The rate at which a stock's price

Q327: The equivalent annual cost can be defined

Q352: You would like to invest in the

Q379: How much are you willing to pay

Q379: When the present value of the cash

Q382: The Good Life offers a common stock