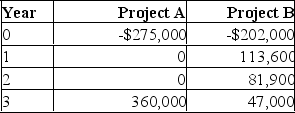

You are considering two mutually exclusive projects with the following cash flows. Which project(s) should you accept if the discount rate is 7 %? What if the discount rate is 10 %?

Definitions:

Time Horizon

The length of time over which an investment is expected to be held or a financial goal is to be achieved.

Standard Deviation

A measure of the dispersion or variability in a dataset, commonly used in finance to assess the volatility of an asset's returns over time.

Volatility

is a statistical measure of the dispersion of returns for a given security or market index, often used as a measure of risk.

Normal Distribution

A probability distribution that is symmetric around the mean, showing that data near the mean are more frequent in occurrence than data far from the mean.

Q31: Incremental cash flows are defined as:<br>A) The

Q53: What is the profitability index of the

Q74: If a company has a current stock

Q78: If a company has a current stock

Q199: You are analyzing a project and have

Q234: Using the tax shield approach, calculate OCF

Q309: KN Jewelers purchased some land four years

Q324: You have decided that you would like

Q374: Uptown Homes just paid a $1.60 annual

Q401: The average accounting return (AAR) rule can