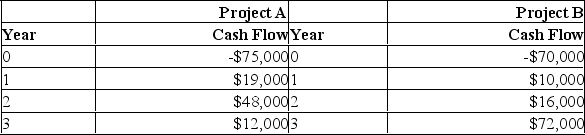

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

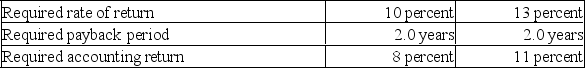

Based on the net present value method of analysis and given the information in the problem, you should:

Based on the net present value method of analysis and given the information in the problem, you should:

Definitions:

Place Within An Organization

The role, position, or status an individual occupies within an organizational structure.

Katz's Skills Model

A framework suggesting that effective leadership depends on three basic personal skills: technical, human, and conceptual.

Top Management

The highest level of management in an organization, responsible for strategic decision-making and overall direction.

Market Fluctuations

Changes in market prices and rates that occur due to varying supply and demand, investor sentiment, or external factors.

Q33: The cash flow from projects for a

Q110: A situation in which taking one investment

Q197: KLS, Inc. is considering a four-year project

Q216: Gen-Y corporation's current stock price is $50

Q239: The crossover point is defined as the

Q244: When considering mutually exclusive investment projects with

Q301: The evaluation of a project based solely

Q306: Gerold's Travel Service just paid $1.79 to

Q329: The New Blues Co. is considering two

Q371: You need to borrow $2,000 quickly, and