Multiple Choice

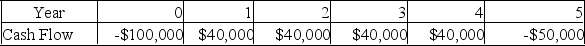

You are considering an investment with the following cash flows. Your required return is 10%, you require a payback of three years and a discounted payback of four years. If your objective is to maximize your wealth, should you take this investment?

Definitions:

Related Questions

Q42: The Scott Co. has a general dividend

Q49: Project A has a five-year life and

Q58: If a project has a net present

Q72: You are considering two mutually exclusive projects

Q151: The IRR is the most widely used

Q162: From a finance perspective, discounted payback is

Q186: Duration is a useful measure of interest

Q286: There are 5 seats open on the

Q305: You are considering a project with an

Q342: Annmarie is considering a project which will