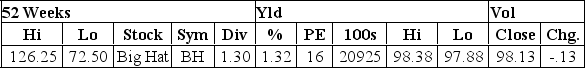

You believe that the required return on Big Hat stock is 12% and that the expected dividend growth rate is 10%, which is expected to remain constant for the foreseeable future. Is the stock currently overvalued, undervalued, or fairly priced?

You believe that the required return on Big Hat stock is 12% and that the expected dividend growth rate is 10%, which is expected to remain constant for the foreseeable future. Is the stock currently overvalued, undervalued, or fairly priced?

Definitions:

Fear Of Driving

An anxiety disorder characterized by an intense fear or phobia of driving a vehicle.

Post-Traumatic Stress Disorder

A mental health condition triggered by experiencing or witnessing a terrifying event, characterized by flashbacks, nightmares, severe anxiety, and uncontrollable thoughts about the event.

Vivid Flashbacks

Intensely clear and powerful memories of past experiences, often associated with traumatic events, that involuntarily come to mind.

PTSD

Post-Traumatic Stress Disorder, a condition of persistent mental and emotional stress occurring as a result of injury or severe psychological shock.

Q9: Stocks are different from bonds because _.<br>A)

Q14: Provide an appropriate definition of Fisher effect.

Q17: Jack owns 35 shares of stock in

Q47: You are attempting to value the shares

Q162: From a finance perspective, discounted payback is

Q203: The semi-annual, 8% coupon bonds of Merriweather,

Q213: The Brown Company just announced that it

Q223: Shares of Do Naught common stock are

Q244: Provide an appropriate definition of clean price.

Q324: Debt can be subordinated to equity.