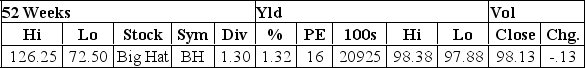

Assume the expected growth rate in dividends is 7%. Then the constant growth model suggests that the required return on Big Hat stock is:

Assume the expected growth rate in dividends is 7%. Then the constant growth model suggests that the required return on Big Hat stock is:

Definitions:

Maturity Value

For an interest-bearing note, it is the sum of the face value (principal) and the interest dollars: MV = P + I.

360-Day Year

An accounting assumption that simplifies interest calculations by using a year composed of twelve 30-day months.

Leap Years

Years that contain 366 days instead of the usual 365, with an extra day added to February, occurring every four years to maintain the calendar year's alignment with the Earth's revolutions around the Sun.

Interest Computation

The process of calculating the amount of interest due on a loan or investment based on the principal amount, rate, and time.

Q16: The Windjammer Co. bonds are currently selling

Q50: Bastion Corporation issued $100 million bonds that

Q58: A corporate bond is quoted at a

Q154: The closing price of a stock is

Q257: The increase you realize in buying power

Q275: Banner Corporation will not pay dividends until

Q298: A bond that pays interest annually yields

Q336: Baker Foods made two announcements concerning its

Q390: Protective covenants:<br>A) Are primarily designed to protect

Q414: Matt is analyzing two mutually exclusive projects