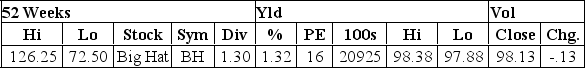

You believe that the required return on Big Hat stock is 12% and that the expected dividend growth rate is 10%, which is expected to remain constant for the foreseeable future. Is the stock currently overvalued, undervalued, or fairly priced?

You believe that the required return on Big Hat stock is 12% and that the expected dividend growth rate is 10%, which is expected to remain constant for the foreseeable future. Is the stock currently overvalued, undervalued, or fairly priced?

Definitions:

Prototypes

Original models or first instances from which other forms are copied or developed, often used in the context of design and innovation.

Influential Person

An individual whose actions, thoughts, or presence has a significant impact on others or on society at large.

Fuzzy Set

A concept in mathematics and social sciences describing a set of elements with degrees of membership rather than a clear boundary between members and non-members.

Vividness

An intrinsic property of a stimulus on its own that makes it stand out and attract attention.

Q103: You presently own stock that you purchased

Q173: If investors require a 7% nominal return

Q189: Define what is meant by interest rate

Q244: The rate at which the stock price

Q285: The short alphabetic abbreviation for an exchange-listed

Q287: The Goodie Barn has a 7% coupon

Q341: You are considering the following projects but

Q357: Provide an appropriate definition of indenture.

Q371: A supernormal growth stock generally:<br>A) Is associated

Q377: The Zilo Corp. has 1,000 shareholders and