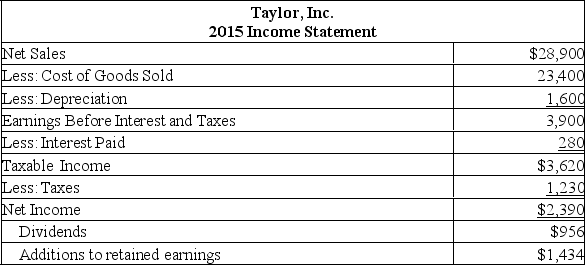

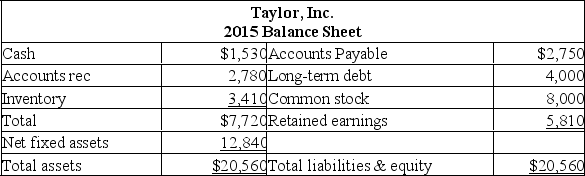

The following balance sheet and income statement should be used:

Assume that Taylor, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are constant. What is the projected increase in total assets if sales are projected to increase by 25%?

Assume that Taylor, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are constant. What is the projected increase in total assets if sales are projected to increase by 25%?

Definitions:

Maturities

The dates on which debt instruments (such as bonds) or other financial contracts come due for payment of principal and interest.

Consumer Savings

Refers to the portion of disposable income that is not spent on consumption but is saved by individuals, often placed in savings accounts or invested.

Business Investment

Expenditures made by businesses to purchase capital goods or services intended to increase their productive capacity or efficiency.

Financial Instruments

Contracts that give rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Q2: Jennifer invested $2,000 in an account that

Q13: Days' sales in inventory of car dealerships

Q32: Granny puts $35,000 into a bank account

Q112: A Toronto firm wants to maintain a

Q131: Which of the following are constant under

Q185: Atlasta Limo Corp. has an average collection

Q212: How much would you have to invest

Q228: Provide a definition of discount rate.

Q258: Which one of the following statements is

Q371: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt="