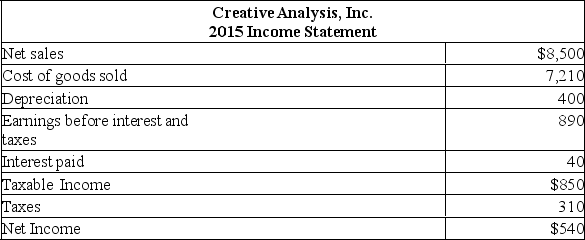

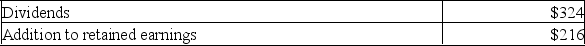

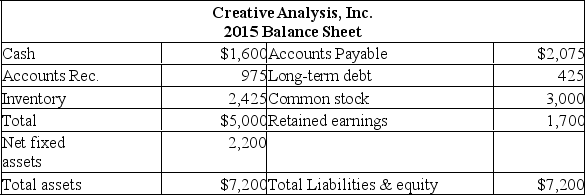

Creative Analysis, Inc. is currently operating at 70 percent of capacity. All costs and net working capital vary directly with sales. The tax rate, the profit margin, and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 10%?

Creative Analysis, Inc. is currently operating at 70 percent of capacity. All costs and net working capital vary directly with sales. The tax rate, the profit margin, and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 10%?

Definitions:

Q59: Dale invests $500 in an account that

Q161: A firm has current sales of $940,000

Q194: Calculate the external financing needed given the

Q199: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q232: To create the same future value given

Q252: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Assume

Q297: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" The

Q318: If a firm is to grow at

Q329: Jack's currently has $798,200 in sales and

Q400: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What