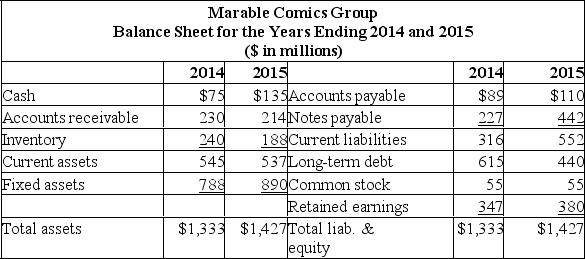

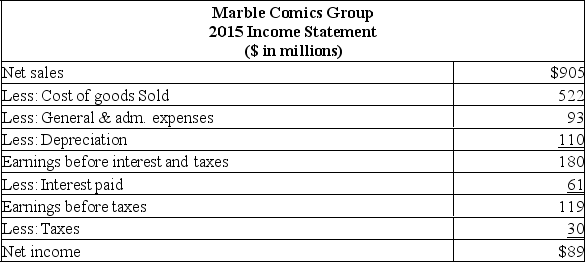

Assume Marble is projecting a 20% increase in sales for the coming year, with current assets, all costs, and current liabilities proportional to sales. Long-term debt is not proportional to sales. If the firm's tax rate remains unchanged, the dividend payout is 40%, and Marble is operating at 70% of capacity, what is the external financing needed (EFN) for 2018 ($ in millions) ?

Assume Marble is projecting a 20% increase in sales for the coming year, with current assets, all costs, and current liabilities proportional to sales. Long-term debt is not proportional to sales. If the firm's tax rate remains unchanged, the dividend payout is 40%, and Marble is operating at 70% of capacity, what is the external financing needed (EFN) for 2018 ($ in millions) ?

Definitions:

Q14: Present values increase as the discount rate

Q47: The greater the number of years, the:<br>A)

Q90: Today Richard is investing $1,000 at 5%

Q95: The rate of return used when computing

Q145: You own a stamp collection that is

Q167: The interest rate expressed in terms of

Q216: Using the excess capacity scenario model, determine

Q279: You recently filed suit against a company.

Q299: You are trying to use your financial

Q405: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Based