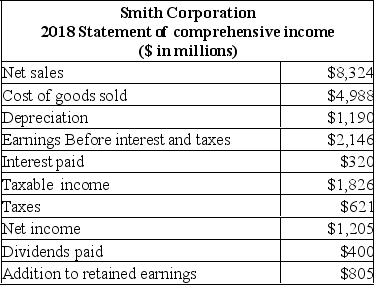

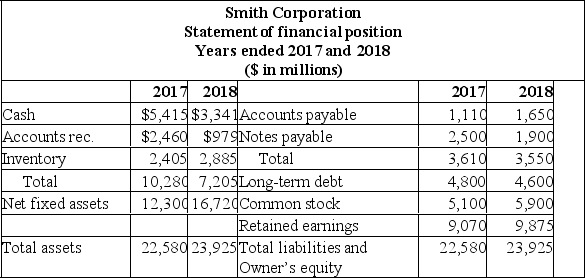

What is the net working capital turnover rate for 2018?

What is the net working capital turnover rate for 2018?

Definitions:

Regressive

Describing a tax system where the tax rate decreases as the taxpayer’s income increases, placing a larger burden on lower-income individuals.

Taxable Income

Taxable income is the portion of your gross income that's subject to taxes after deductions and exemptions.

Tax Liability

The total amount of tax owed to the government after all deductions, credits, and prepayments have been taken into account.

Tax Refund

The amount of money returned to a taxpayer by the government when the taxpayer's total tax payments exceed their tax liability for a given year.

Q1: A source of cash is defined as:<br>A)

Q67: ABC, Inc. is operating at full capacity

Q105: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" The

Q140: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q197: A firm has current assets of $400,

Q237: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q281: During the year, The Train Stop decreased

Q349: The financial ratio days' sales in receivables

Q362: The following balance sheet and income statement

Q411: A British Columbia resident earned $30,000