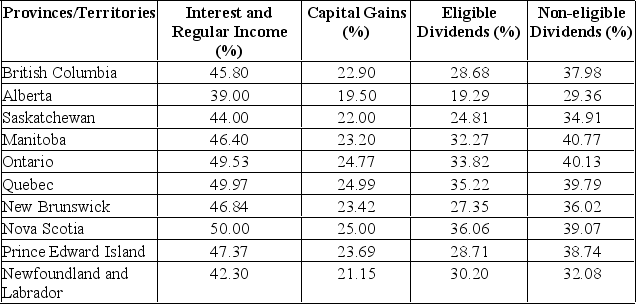

A Manitoba resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid. Combined marginal tax rates for individuals in top provincial tax brackets

Definitions:

Atlantic Slave Trade

The transatlantic trading patterns which were established from the 16th through the 19th centuries, which transported millions of Africans to the Americas as slaves.

Southern Ohio

A region in the United States characterized by its geographical location within the state of Ohio, often noting its distinct cultural and historical features.

New England Settlers

Refers to the early colonists and immigrants who established the first English colonies in the northeastern part of what is now the United States.

Q36: The financial ratio measured as net income

Q101: Assume a firm has depreciation, taxes, and

Q137: If a firm acquires more long-term debt

Q170: Calculate net income given the following information:

Q205: How would a $15,000 decrease in AR

Q216: Ajax Corporation's total current assets are valued

Q352: Julie's Boutique paid $400 in dividends and

Q359: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q377: A firm's marginal tax rate may differ

Q397: A Halifax firm has an interval measure