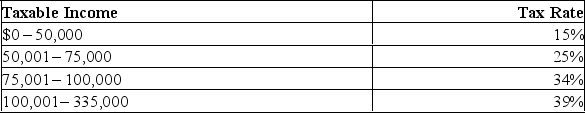

Given the tax rates as shown, what is the average tax rate for a firm with taxable income of $218,740?

Definitions:

Compensatory Decision

A decision-making process where the consumer evaluates the positive and negative attributes of each alternative and makes a trade-off to arrive at a decision.

Unrealistically High

describes a level or amount that exceeds practical possibilities or reasonable expectations, often in context to prices or goals.

Marketers

Professionals responsible for promoting, selling, and distributing a product or service, including market research and advertising to reach potential consumers.

Social Influence

The effect that the words, actions, or mere presence of other people have on an individual’s thoughts, feelings, attitudes, or behaviors.

Q35: Provide several disadvantages of a partnership?

Q49: What is a major advantage of using

Q76: Describe two types of business organizations in

Q106: Why might a corporation wish to list

Q120: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q210: A financial manager who needs to find

Q258: What does cash flow from assets represent?

Q268: Calculate the times interest earned ratio given

Q325: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" If a firm

Q405: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What