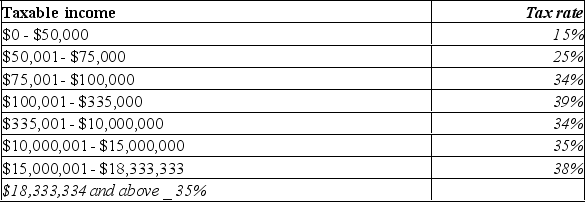

If a firm has taxable income of $17.5 million and a total tax bill of $6.1 million, its average tax rate is _______.

If a firm has taxable income of $17.5 million and a total tax bill of $6.1 million, its average tax rate is _______.

Definitions:

Gross Assets

The total value of all assets owned by an entity before deducting any liabilities or depreciation.

GAAP

Generally Accepted Accounting Principles, a standard framework of guidelines for financial accounting.

Earnings Benchmarks

Standards or metrics against which a company's profitability can be measured.

Discretionary Spending

Expenditures made at the discretion of a business or individual, which are non-essential and can be adjusted or eliminated.

Q46: The best definition of agency problem is:<br>A)

Q70: The best definition of capital structure is:<br>A)

Q144: Marla's Homemade Cookies has net income of

Q215: A firm has common stock of $5,500,

Q224: What does cash flow from assets represent?

Q256: Current assets minus current liabilities are referred

Q335: Given the following statement of comprehensive income

Q363: The times interest earned ratio is defined

Q381: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q399: At the beginning of the year, a