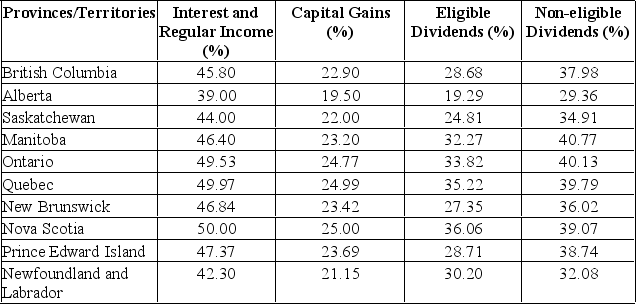

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in interest income and $25,000 in capital gains.

Definitions:

Q20: Funder argues that a basic approach that

Q37: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Determined the provincial

Q54: How does unconscious conflict affect well-being?<br>A)Applied<br>B)Biological<br>C)Learning<br>D)Phenomenological<br>E)Psychoanalytic<br>F)Trait<br>

Q58: Which one of the following statements is

Q127: The financial statement that summarizes the sources

Q135: Calculate gross profit ratio given the following

Q145: Su Lee's has sales of $54,600, total

Q212: The financial statement summarizing a firm's performance

Q225: A firm has 5,000 shares of stock

Q406: Last year, New Flying Industries had a