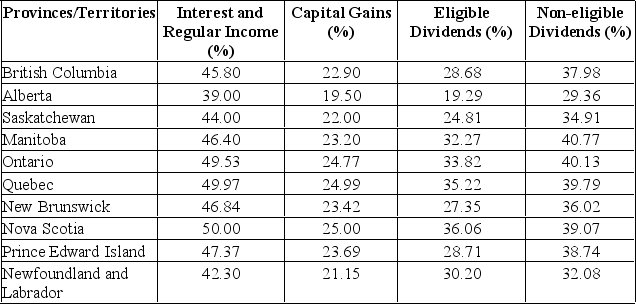

Calculate the tax difference between a British Columbia resident and an Alberta resident both having $20,000 in capital gains and $10,000 in eligible dividends.

Definitions:

Settlement

An agreement reached by disputing parties outside of court or the process of resolving a dispute through such an agreement, often involving some form of compensation.

Court-ordered Support

Financial assistance mandated by a court, typically in the context of divorce or separation, for the support of a spouse or children.

Visitation Agreement

A legally binding document outlining the terms under which a non-custodial parent may visit their child, often included in divorce settlements.

Vengeful Parent

Refers to a parent who acts out of spite or seeks revenge through actions that negatively affect the other parent, often seen in contested custody or divorce situations.

Q16: How do people from individualist cultures differ

Q23: Which subfield of psychology uses personality psychology

Q54: Square D's has $42,700 in sales and

Q67: The term capital structure describes:<br>A) The mixture

Q77: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" The

Q81: On a common-base year financial statement, all

Q91: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q166: A partnership:<br>A) Is taxed the same as

Q182: The net new equity raised by a

Q233: On the statement of cash flows, the