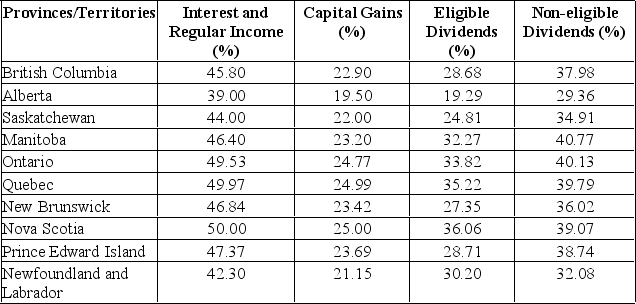

Calculate the tax difference between a British Columbia resident and a Quebec resident both having $20,000 in interest income and $25,000 in capital gains.

Definitions:

Cash

Currency and coins, along with funds in bank accounts and other forms of immediately available funds.

Accounting Equation

The foundation of double-entry bookkeeping, stating that assets are equal to the sum of liabilities and owner's equity: Assets = Liabilities + Owner's Equity.

Owner's Equity

The residual interest in the assets of the entity after deducting liabilities, representing what the owners or shareholders own outright in the company.

Liabilities

Financial obligations a company owes to outside parties.

Q76: A firm has net working capital of

Q77: Which of the following is incorrect regarding

Q103: There is a possibility that individuals are

Q192: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q193: The process of planning and managing a

Q198: The current ratio is measured as:<br>A) Current

Q214: The person generally directly responsible for overseeing

Q234: Capital structure determines the level of current

Q242: Which statement best describes hedge funds:<br>A) Hedge

Q265: Operating cash flow can be computed as:<br>A)