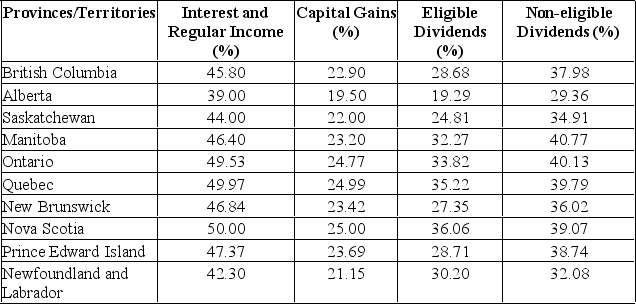

Calculate the tax difference between a British Columbia resident and a Quebec resident both having $20,000 in capital gains and $10,000 in eligible dividends.

Definitions:

Anomaly

A deviation from the common rule, type, arrangement, or form; something that does not fit into the normal pattern or expected results.

Chocolate Frosting

A sweet, chocolate-based spread, often used as a topping or filling for cakes and other desserts.

Morpheme

The smallest grammatical unit in a language, a word or a part of a word that contains meaning and cannot be further divided.

Phonology

The study of the ways speech sounds are combined and altered in language.

Q43: Which of the following is not a

Q46: Without making reference to its formula, provide

Q46: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q58: What is the triple bottom line? What

Q67: Provide a list of the top ten

Q83: Stakeholder theory suggests that employees, customers, suppliers,

Q235: The decisions made by financial managers should

Q293: A computer used in a business office

Q356: All else constant, the cash flow to

Q393: Which of the following are included in