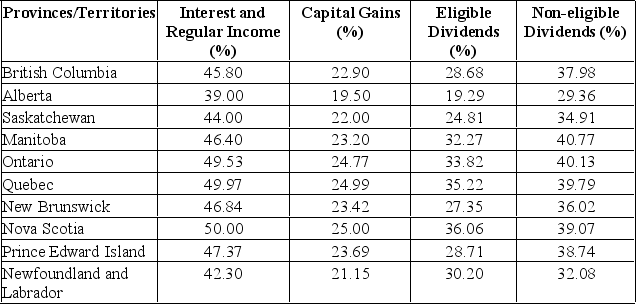

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in capital gains and $10,000 in eligible dividends. Combined marginal tax rates for individuals in top provincial tax brackets

Definitions:

Register

To record or enroll formally, often in the context of registering to vote, or the action of capturing and storing information.

Cumulative Voting

A voting system that allows shareholders to allocate all of their votes to one candidate, enhancing minority shareholders' chances of influencing board election outcomes.

Board of Directors

A group of individuals elected by shareholders to oversee the major decisions and policies of a corporation.

Common Stock

A form of corporate equity ownership, a type of security that represents ownership in a corporation, entitling the owner to a proportion of the company's assets and profits.

Q24: NASDAQ is:<br>A) The largest financial market in

Q140: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q175: Return on equity will increase if the

Q180: A new firm issued $500 in common

Q183: Calculate the current ratio given the following

Q226: The mix of debt and equity by

Q321: On a common-size statement of financial position,

Q336: Operating cash flow is best described as:<br>A)

Q340: List and interpret three liquidity ratios.

Q355: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What