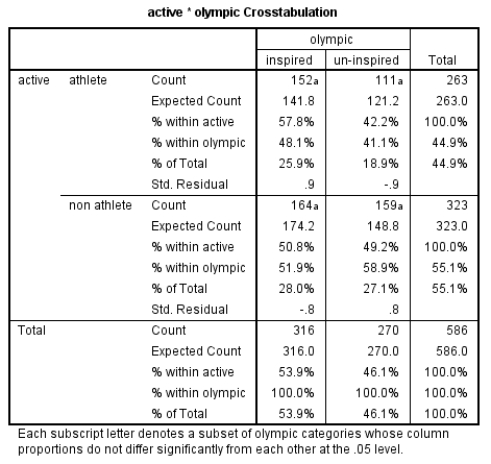

Examine the table below. What do the z-scores (i.e. standardized residuals) for the two variables tell us?

Definitions:

Weighted Average Cost of Capital

Weighted Average Cost of Capital (WACC) is a calculation of a company's cost of capital in which each category of capital is proportionately weighted.

Tax Shield

The reduction in income taxes that results from taking an allowable deduction from taxable income, such as interest on debt.

Capital Structure

The mix of debt and equity financing a company uses to fund its operations and growth.

M&M Proposition II

Modigliani and Miller's Proposition II states that a company's cost of equity increases as it increases its leverage due to the risk premium on equity.

Q2: To get the name of a calling

Q8: What does c in a straight line

Q12: You work for a performance sports clothing

Q13: In the same context as Q4,consider the

Q15: Examine the histogram of the qualifying distance

Q15: If a Kolmogorov-Smirnov test is conducted and

Q16: Which of the following descriptions best describes

Q16: Which of the following is the most

Q22: When researching the effects of heart rate

Q29: A _ is a boolean variable that