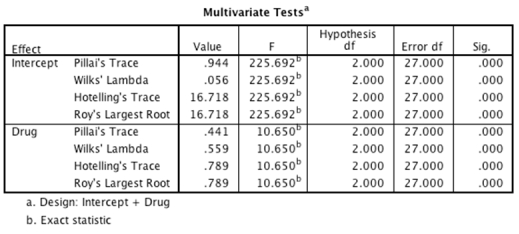

A scientist was interested in the success of a newly developed sleep aid called 'Night Owl' on time taken to fall asleep and quality of sleep.She recruited 30 participants who were randomly allocated to receive either a dose of Night Owl or a placebo.The scientist measured the mean time taken for each participant to fall asleep (minutes) and the quality of their sleep (measured on a scale of 1 (poorest quality) to 10 (best possible quality) ) over the course of one week. What can the scientist conclude from the output below?

Definitions:

Underlying Asset

The financial asset upon which a derivative instrument, such as a futures or options contract, is based.

Convertible Bond

A bond with an option allowing the bondholder to exchange the bond for a specified number of shares of common stock in the firm. The conversion ratio specifies the number of shares. The conversion price is the current value of the shares for which the bond may be exchanged. The conversion premium is the excess of the bond’s value over the conversion value.

Straight-Bond Value

The value of a bond calculated without considering any embedded options, based purely on its coupon payments and maturity value.

Conversion Value

The monetary value of a convertible security if it were converted into a different form, usually shares of the company's common stock.

Q3: Looking at the table below,which variables were

Q4: In the following table,how many mistakes are

Q4: Which of the following is not a

Q7: When two variables are correlated with each

Q7: Which of the following statements best defines

Q11: The _ test is based on calculating

Q12: McNemar's test is appropriate to use on

Q16: If a MANOVA is significant,what would the

Q17: A psychologist was interested in whether there

Q20: Two-way ANOVA is basically the same as