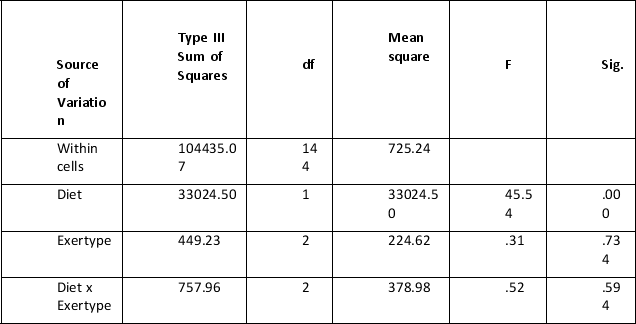

In a study on the influence of exercise type on pulse rate and dependence on dietary preference, the following table details Tests of Between-Subjects Effects.  The following output is produced for diet x intensity

The following output is produced for diet x intensity

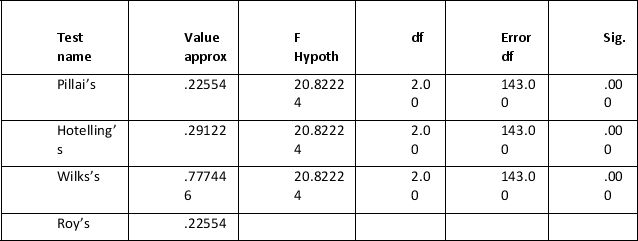

Multivariate tests of significance (S = 1, M = 0, N = 701/ 2)  Source: http:/ / ssc.utexas.edu/ docs/ stat38.html

Source: http:/ / ssc.utexas.edu/ docs/ stat38.html

The reported findings are written as follows

F(1, 143) = 20.82, p = .000

What do you deduce by this result?

Definitions:

Taxes

Essential fees levied by authorities on personal and corporate income, or added onto the costs of selected merchandise, services, and operations.

Tax Revenue

Income earned by the government from taxing individuals and businesses.

Tax

An obligatory fiscal charge or another form of assessment applied to a taxpayer by a government body to finance government operations and diverse public expenses.

Deadweight Loss

Deadweight loss is an economic inefficiency that arises when a market outcome is not optimal, resulting in a loss of total surplus due to factors like taxes or monopolies.

Q1: Standard Precautions apply when handling all of

Q3: What does the presence of parallel lines

Q12: If the null hypothesis is true and

Q15: Winged infusion sets are best used for:<br>A)

Q17: In a research experiment that looks at

Q17: When would you use the Kruskal-Wallis test?<br>A)

Q19: Imagine we wanted to investigate whether the

Q20: The _ and _ tests are calculated

Q28: A discriminate function analysis was performed on

Q32: Which of the following is not representative