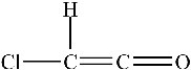

The shapes around the left and right carbon atoms in the structure below are tetrahedral and linear,respectively.

Definitions:

Permanent Differences

Differences between taxable income and accounting income that originate in one period and do not reverse over time, affecting the effective tax rate.

Temporary Differences

Temporary differences are differences between the carrying amount of an asset or liability in the balance sheet and its tax base, leading to deferred tax assets or liabilities.

Taxable Income

Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year.

Pretax Financial Income

Income of a company calculated before taxes are deducted, often compared to taxable income for tax planning.

Q8: How can teachers plan family events that

Q18: Consider the balanced reaction: Zn(s)+ 2 HCl(aq)→

Q18: Which practice has students teach family members

Q26: When writing Lewis structures,the symbol below is

Q39: Ionic compounds are composed of positively and

Q43: Which statement about parent organizations is true?<br>A)They

Q57: A 100-g sample of the compound below

Q66: The enzyme lactase aids in the digestion

Q79: An equilibrium constant with a value of

Q101: When ΔH is negative,the bonds formed in