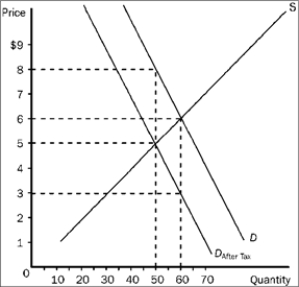

Figure 4-20

-Refer to Figure 4-20. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. Now, relative to the case depicted in the figure,

Definitions:

Valuation Allowance

An accounting procedure that an entity might use against its deferred tax assets indicating that it is more likely than not that some portion or all of the asset will not be utilized.

Trading Investments

Assets held by a firm for the purpose of selling them in the short term to generate profit from price fluctuations.

Unrealized Gain

The increase in value of an asset that has not been sold, and thus the profit has not been realized as the asset remains part of the portfolio.

Income Statement

A report that outlines a company's financial activities, including earnings, expenses, and net profit or loss, during a particular accounting timeframe.

Q21: Data from the effects of the substantial

Q28: Suppose the U.S. Government banned the sale

Q43: In Figure 4-15, suppose a price floor

Q46: Given the following figures, by approximately what

Q70: Darius lent Alejandro $1,000 for one year

Q88: The short-run aggregate supply curve shows the

Q123: Other things constant, a decrease in the

Q157: If there is surplus of loanable funds,

Q204: Your boss gives you an increase in

Q247: If price falls, what happens to the