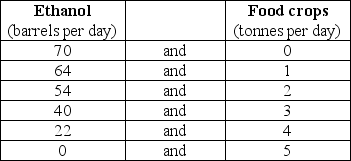

Use the table below to answer the following question.

Table 2.2.1

-Refer to Table 2.2.1.Marginal benefit from food crops

Definitions:

Traded

The act of buying or selling securities, commodities, or other financial instruments on financial markets.

Put-Call Parity

A fundamental principle in options pricing that establishes a specific relationship between the prices of European put and call options with the same strike price and expiration date.

European Put Option

A financial contract that gives the holder the right, but not the obligation, to sell an underlying asset at a specified price on the expiration date.

Exercise Price

The price at which the holder of an option can buy (for a call option) or sell (for a put option) the underlying security.

Q8: The fastest growing group of entrepreneurs in

Q42: As we move down the bowed-out production

Q60: Cross-functional work teams are best supported by

Q69: The entrepreneurial mind-set is found primarily among

Q76: A supply curve is<br>A)the same as a

Q92: Which one of the following will definitely

Q94: Refer to Table 4.1.5.The demand for hotel

Q104: A contest allocates resources to<br>A)a winner or

Q104: While both incremental and radical innovations can

Q120: Trade is organized using the social institutions