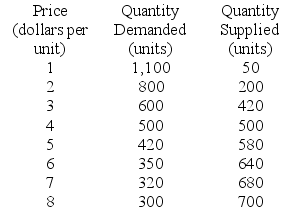

Use the table below to answer the following questions.

Table 3.4.1

-Refer to Table 3.4.1.The equilibrium quantity is 420 units if

Definitions:

Prepaid Expenses

Costs that are paid in advance for goods or services, which are recognized as expenses over time as the benefits are received.

Employer Payroll Taxes

Employer payroll taxes are taxes that an employer is required to pay on behalf of their employees, including Social Security and Medicare taxes in the United States.

FICA Taxes

Taxes imposed on both employees and employers to fund Social Security and Medicare, based on a percentage of payroll.

Federal Income Taxes

The taxes levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Q15: The development of the original personal computer

Q18: When 2,000 hamburgers a day are produced,the

Q49: Refer to Figure 5.3.1.If the quantity produced

Q77: Refer to Table 6.3.1.Suppose a sales tax

Q99: Consider a market for an illegal good.If

Q99: Refer to Table 4.1.3.The price elasticity of

Q139: In general,if country A is accumulating capital

Q143: If price elasticity of demand is zero,then

Q160: Given the data in Table 1A.4.1,holding y

Q174: Refer to Fact 1.1.1.The cost of regenerating