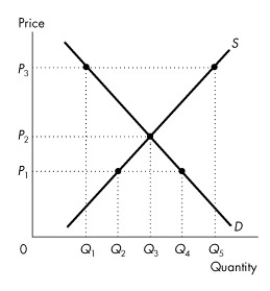

Use the figure below to answer the following questions.

Figure 3.4.1

-At price P₃ in Figure 3.4.1,

Definitions:

Family Structure

The composition and organization of a family, including the relationships and roles within the household.

Emotional Support

Emotional support involves providing empathy, love, and encouragement to someone, helping boost their emotional well-being during times of stress or difficulty.

Social Support

The assistance and comfort received from friends, family, and others, contributing to an individual's sense of belonging, self-esteem, and stress-reduction.

Outcomes Of Divorce

Pertains to the various effects and consequences that divorce can have on individuals, including emotional, financial, and social impacts.

Q2: If enforcement is aimed at sellers of

Q30: If opportunity costs are increasing,then the production

Q37: An oil painting has an opportunity cost

Q65: The idea of fairness that has been

Q66: Which of the following ideas describes the

Q76: A supply curve is<br>A)the same as a

Q101: The demand for corn increases.As a result,the

Q137: Which of the following is an example

Q152: Choose the correct statement.<br>A)Canada produces more services

Q168: Demand is inelastic if<br>A)a small change in