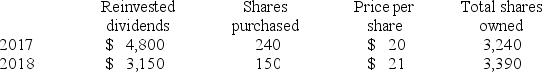

In 2017,Mrs.Owens paid $50,000 for 3,000 shares of a mutual fund and elected to reinvest year-end dividends in additional shares.In 2017 and 2018,she received Form 1099s reporting the following.  If Mrs.Owens sells 1,000 of her 3,390 shares in 2019 for $22 per share and uses the average basis method,compute her recognized gain.

If Mrs.Owens sells 1,000 of her 3,390 shares in 2019 for $22 per share and uses the average basis method,compute her recognized gain.

Definitions:

Cardiac

Pertaining to the heart and its functions.

Skeletal

Pertaining to the framework of bones that supports the body, allows for movement, and protects the internal organs.

Smooth

Describes muscle tissue that lacks striations, is involuntarily controlled, and found in the walls of internal organs.

Cardiac

Relating to the heart, especially pertaining to its function or diseases affecting it.

Q53: The 10% penalty imposed on premature withdrawals

Q54: Frost Inc.,a calendar year U.S.corporation,owns 20 percent

Q64: An independent contractor is not entitled to

Q67: Mr.and Mrs.Stern reported $1,148,340 alternative minimum taxable

Q74: Mr.Lenz died on May 4,2018.His widow,Mrs.Lenz,maintains a

Q108: An extension of the time to file

Q176: Which of the following is NOT associated

Q177: According to Luthans, Hodgetts, and Rosenkrantz, if

Q192: Positive organizational behaviour is the study and

Q226: The psychological capital of individuals can be