Multiple Choice

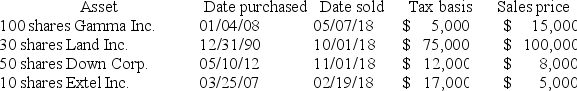

Frederick Tims,a single individual,sold the following investment assets this year.  If Frederick's preferential tax rate on adjusted capital gain is 15%,compute his tax attributable to the above sales.

If Frederick's preferential tax rate on adjusted capital gain is 15%,compute his tax attributable to the above sales.

Identify the demographic groups most affected by poverty.

Understand the funding and administrative structures of key social welfare programs.

Recognize incorrect statements and common misconceptions about poverty and assistance programs.

Understand the principles and criticisms of minimum wage laws.

Definitions:

Related Questions

Q13: Which of the following statements about the

Q17: Which of the following situations result in

Q47: Partnerships offer owners the maximum flexibility to

Q52: Section 401(k)plans allow employees to contribute a

Q60: If a taxpayer fails to pay a

Q86: Family partnerships are generally created when the

Q95: Which one of the following is NOT

Q111: Which goal of the field of organizational

Q141: _ practices can be external or internal.

Q206: In 2013, a new national standard for