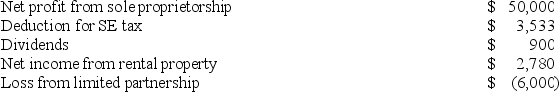

Mr.and Mrs.Nelson operate a small business as a sole proprietorship.This year,they have the following tax information.  Compute Mr.and Mrs.Nelson's AGI.

Compute Mr.and Mrs.Nelson's AGI.

Definitions:

Isocost Line

A graph representing all combinations of inputs that have the same total cost for a firm.

Price of Capital

The cost of borrowing money to purchase or invest in capital assets, often reflected in interest rates or return expectations.

Price of Labor

The compensation received by workers for their services, typically in the form of wages or salaries, which can be influenced by factors such as skill levels, supply and demand, and economic conditions.

Total Expenditure

The aggregate amount of spending by an entity or economy on goods and services, including consumption, investment, government purchases, and net exports.

Q14: GAAP-based consolidated financial statements include only income

Q18: Article 1 of the U.S.Constitution,referred to as

Q26: Macy filed her 2018 tax return on

Q59: Mr.Moyer owns residential rental property.This year,he received

Q71: Lansing Corporation,a publicly held company with a

Q73: A corporation that transfers restricted stock to

Q74: The Schedule M-3 reconciliation requires less detailed

Q83: Both traditional IRAs and Roth IRAs are

Q83: Eileen,a single individual,had $125,000 taxable income.Compute her

Q221: Knowledge of organizational behaviour will help you