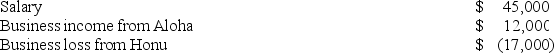

Ms.Mollani owns stock in two S corporations,Aloha and Honu.This year,she had the following income and loss items:

Compute Ms.Mollani's AGI under each of the following assumptions.

Compute Ms.Mollani's AGI under each of the following assumptions.

a.She materially participates in Aloha's business but not in Honu's business.

b.She materially participates in Honu's business but not in Aloha's business.

c.She materially participates in both corporate businesses.

d.She does not materially participate in either business.

Definitions:

Microsociology

The subfield of sociology that focuses on the interactions and social relations among individuals at a small-scale, everyday level.

Unintended Consequences

Outcomes that are not the ones foreseen or intended by a purposeful action, often contrary to the original intentions.

Latent Functions

are the unintended or unrecognized consequences of social processes or structures.

Symbolic Interactionists

Scholars and thinkers who study how people use symbols to create meaning, communicate, and develop their views of the world and themselves.

Q2: Mr.and Mrs.Arlette spent $5,900 for child care

Q14: Mr.and Mrs.Shohler received $25,200 Social Security benefits

Q41: For federal income tax purposes,property transfers pursuant

Q42: Which of the following statements about investment

Q43: In computing taxable income,an individual is allowed

Q59: The IRS agent who audited the Form

Q71: The federal income tax system provides incentives

Q78: Mrs.Lee,age 70,withdrew $10,000 from her Roth IRA

Q91: This year,Nilo Inc.granted incentive stock options (ISO)to

Q176: Which of the following is NOT associated