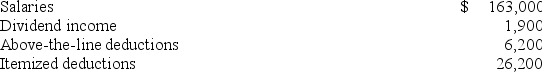

Mr.and Mrs.Dell,ages 29 and 26,file a joint return and have no dependents for the year.Here is their relevant information: Standard Deduction Table.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

Definitions:

Total Liabilities

The sum of all monetary obligations a company owes to external parties, such as loans, accounts payable, and mortgages.

Owner's Equity

Represents the residual interest in the assets of a business after deducting liabilities, essentially the net worth belonging to the owners.

Total Assets

Represent the sum of all assets a company owns, including cash, inventory, property, and equipment, among others, showing the total value of what the company controls.

Period Of Time

A duration in which activities, processes, or conditions exist or take place.

Q11: Jane,a cash basis individual,purchased a publicly traded

Q16: An individual who wants to roll over

Q22: Ms.Jorland is a 30-year old single taxpayer.Her

Q55: Rebecca has a qualifying home office.The room

Q60: Mr.and Mrs.Daniels,ages 45,and 42,had the following income

Q76: Ms.Dela filed her unextended 2018 Form 1040

Q79: For dividends received prior to 2018,the deemed

Q92: When a corporation is thinly capitalized,the IRS

Q103: Qualified dividend income earned by individual taxpayers

Q109: DFJ,a Missouri corporation,owns 55% of Duvall,a foreign