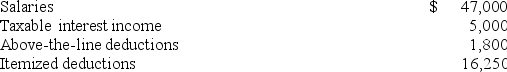

Mr.and Mrs.Liddy,ages 39 and 41,file a joint return and have no dependents for the year.Here is their relevant information: Standard Deduction Table.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

Definitions:

Academically Successful

Describes achieving high grades or excelling in educational pursuits through effective study habits and intellectual engagement.

Drug Use

The consumption of substances, which can alter the body's function or mind, ranging from prescribed medications to recreational drugs.

Parenting Style

The manner in which parents raise their children, characterized by different levels of responsiveness and demandingness.

Adolescence to Adulthood

The transitional stage from childhood to full maturity, encompassing physical, psychological, and social changes.

Q11: Which of the following statements regarding Keogh

Q19: Which of the following statements is false?<br>A)The

Q31: Corporate taxable income earned before December 31,2017

Q32: Poppy's book income of $739,300 includes a

Q50: What is positive organizational behaviour and how

Q55: Lars withdrew $20,000 from a retirement account

Q58: Which of the following statements about the

Q67: Chester,Inc.,a U.S.multinational,earned $4 million this year from

Q69: A U.S.parent corporation that receives a dividend

Q84: A person can't be relieved of liability