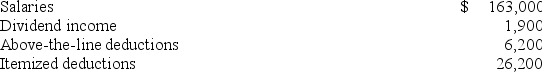

Mr.and Mrs.Dell,ages 29 and 26,file a joint return and have no dependents for the year.Here is their relevant information: Standard Deduction Table.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

Definitions:

Tectonically Active

Describing regions where the Earth's tectonic plates meet and interact, causing earthquakes, volcanic activity, and mountain building.

Supports Life

The capacity of an environment or planet to provide suitable conditions and necessary resources for living organisms to survive and reproduce.

Generates Heat

The process of transforming energy into heat, which can occur through various means such as chemical reactions, electrical resistance, or nuclear reactions.

Density

A measure of mass per volume, used to describe the compactness of a substance.

Q8: Emil Nelson paid $174,500 for an annuity

Q15: A taxpayer who realizes a loss on

Q23: The United States taxes its citizens on

Q45: Funky Chicken is a calendar year S

Q46: Bernard and Leon formed a partnership on

Q48: Which of the following amounts are not

Q61: In 2019,Mr.Ames,an unmarried individual,made a gift of

Q64: The personal holding company tax is a

Q107: Which of the following statements regarding employee

Q115: Mr.and Mrs.Lansing,who file a joint tax return,have